Picture this. You have worked so hard to get the wealth that you have and there are so many things you want to do to enjoy that wealth. However, you want to invest some of that wealth and spend a significant part of it wisely but you do not know how to go about it. That is why professional wealth management experts exist.

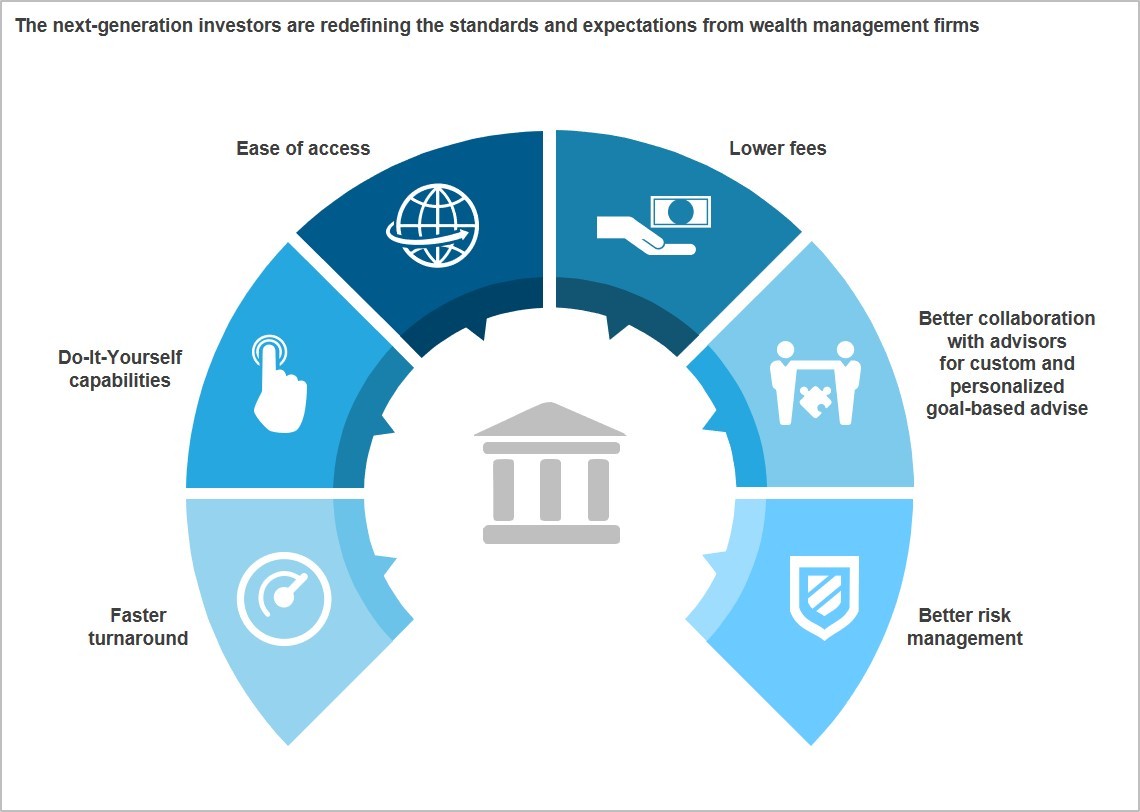

The wealth management industry has been growing rapidly thanks to the increasing number of high net worth individuals. Often times wealth management services exist within the scope of the banking industry. The demand for the services has also contributed to the need for more specialization in that sector, thus leading to the creation of specialized services in the segment and this is where data and analytics come in.

Wealth management is not just about a better private banking experience. It also has to do with things like tax planning, estate planning, access to institutional services, retirement planning, insurance management, investment management, and risk management.

How do data and analytics apply to wealth management?

The data & Analytics segment exists mainly to help businesses or companies solve complex problems while at the same time allowing them to generate more value in their operations. The ultimate goal of Data & Analytics is thus to help achieve better performance and growth. To understand how and why this applies to wealth management, we must first understand the scope of wealth management. Below are some of the focal points of wealth management services.

- To provide the best possible experiences for clients– Modern-day wealth management services aim to leverage technology to provide flexible services. It thus involves the use of digital technologies. Data & Analytics allow them to create systems that can optimize their offerings to suit client needs, thus helping to achieve client satisfaction.

- Using highly specialized digitized client interactions to boost client loyalty– Client loyalty is easy to achieve if you can manage to provide the best integration of services that will offer the best value to customers. Digital interactions, in this case, means seamless experience on digital channels such as e-commerce, digitized mobility services like Uber and other tech-based solutions. Data and analytics present an avenue through which wealth management services can develop highly specialized wealth management services that can achieve the highest level of digitized client interactions while offering a high level of security.

- Full digitization– traditional wealth management involves having an actual relationship banker or investment who handles the financial needs of the client while also providing them with an investment banker. However, the digital shift means that these services can be provided digitally where the wealth management service can provide innovative digital tools to help clients keep track of their wealth and spending with the highest level of efficiency.

Wealth management services in the modern world can use mobile platforms to roll out the full scope of their services including onboarding, automated systems advice and account aggregation. On the back-end, they can leverage big data, portfolio analytics, onboarding, CRM and cloud computing among other digital solutions to fully realize the power of data & Analytics s in wealth management.